FAST Channels in Europe: Insights on Growth in a Changing Market

FAST channels are rapidly expanding their presence in the media landscape. However, this growth comes with its own set of challenges, as the shifting market demands more from channels to thrive.

FAST, short for Free Ad-Supported TV, refers to streaming channels that don’t require a paid subscription. Instead, they rely on advertising as their primary revenue stream. Positioned between traditional linear TV and paid streaming services, FAST offers a unique viewing experience.

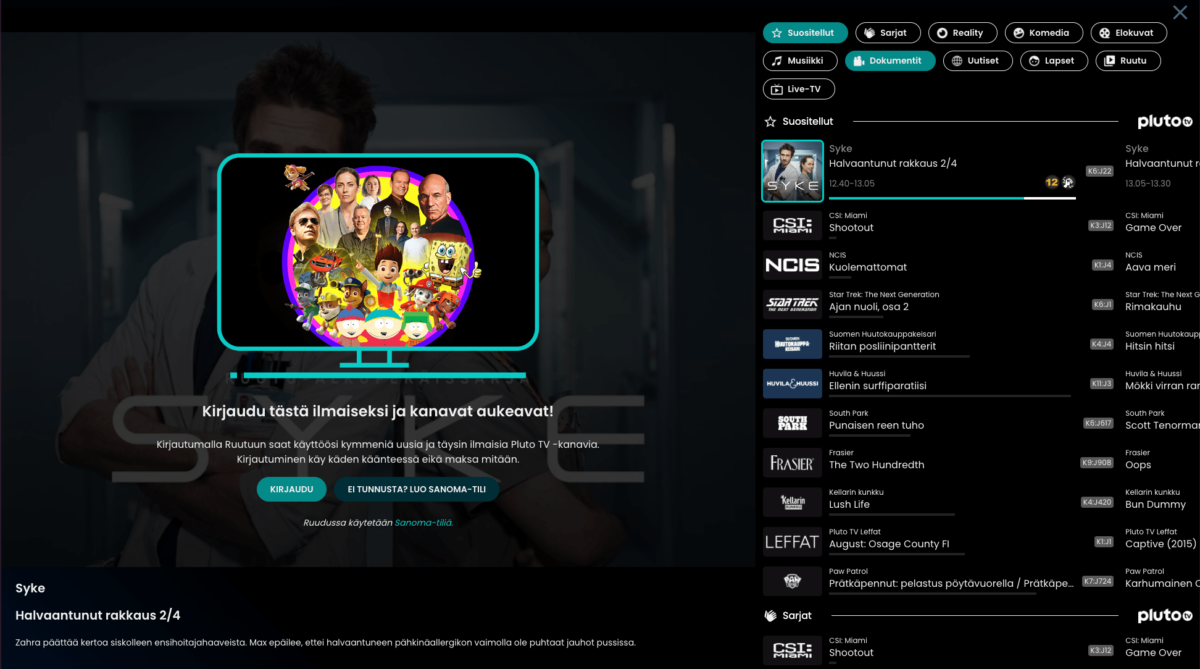

Some of leading FAST channel service providers in Europe include Pluto TV, Rakuten TV, The Roku Channel, Samsung TV Plus, Tubi, and Xumo.

At IBC2024, FAST was a huge topic of discussion. The Content strategies for FAST in Europe panel looked at the future of FAST and the opportunities for growth in Europe. The panel also addressed the differences between FAST in Europe and the US. Setting the pace for FAST in Europe? The Monetisation and motivations panel looked at the best ways to find your position in the market.

We have been at the forefront of bringing the first and largest FAST channels to Finland, so this is a topic very close to our hearts. In this article we have compiled in a concise package the panels’ key insights on the current state and future of FAST channels in Europe.

FAST in Europe

FAST channels really took off on the European broadcasting landscape in 2022, when their viewing figures almost doubled. This was the result of both a change in consumer habits and an increase in the number of FAST channels. In the UK, France, Germany, Italy, Spain and France alone, there are almost 1 200 FAST channels.

The panel discussion underscored a key issue: the oversaturation of channels in the current market. In 2023, the number of channel closures will come close to matching the number of new launches. The primary reason for this is the entry of major broadcasters into the FAST space, which has elevated quality standards but simultaneously reduced visibility for smaller channels.

The most successful among these have been the so-called single IP channels—those that focus exclusively on a single program. Service providers may operate multiple channels, with each one dedicated to just one show or series.

How does US FAST differ from European FAST?

FAST has a longer history in the United States compared to Europe. Among the largest providers in the U.S. are Pluto TV, Tubi, Roku Channel, and certain offerings from Amazon Prime Video. FAST currently accounts for between 4.4% and 7.8% of total national viewership.

A key difference between the U.S. and Europe is the type of content consumed. In Europe, entertainment content dominates FAST, while in the U.S., news takes the top spot. To be more precise, entertainment makes up 37% of FAST content in Europe, while in the U.S. it’s 25%. On the other hand, news accounts for 11% of FAST content in Europe, but a significant 42% in the U.S.

When it comes to growth potential, two major challenges for FAST channels in Europe were highlighted. First, it’s harder to attract advertisers due to Europe’s fragmented linguistic and cultural landscape, making it difficult to reach large consumer bases. Second, Europe has far more free TV channels than the U.S., where viewers are more accustomed to paying for content. This creates a challenge for FAST to carve out its own niche in Europe.

Despite the FAST model being more established in the U.S., it’s currently experiencing stronger growth in Europe and is also expanding rapidly in other regions across the globe.

Three challenges

FAST is currently following an interesting path. It grows rapidly in Europe, but at the same time the competition is constantly getting tougher. The panelists listed three challenges that channels need to overcome to survive in the FAST market:

Discoverability

As mentioned, the FAST channel landscape is becoming increasingly crowded. So how can these channels carve out their own space in the market?

The key lies in content. As the number of channels grows, those that broadcast the most well-known and popular content have naturally seen the most success. Many niche channels, on the other hand, have struggled to attract enough viewers.

However, this doesn’t mean that only the most popular programming will guarantee success. While mainstream content may initially draw in large audiences, it doesn’t necessarily ensure long-term viewer loyalty. Plus, it’s clear that there isn’t enough top-tier programming to go around, nor does everyone want to watch the same shows. This creates a vital space for diverse content and a variety of channels.

Quality gap

In the early days of FAST, before the major broadcasters entered the scene, mid-sized and smaller channels fared much better. Larger companies, with their vast resources, are now able to deliver higher-quality content and maintain robust technical standards. Smaller channels often struggle to compete on the same level.

But this gap in quality isn’t an insurmountable obstacle. When we talk about broadcast quality, we’re mainly referring to how content is delivered. The expectation is that channels acquire high-quality content, but it’s their responsibility to ensure that this content reaches viewers seamlessly.

To guarantee high-quality broadcasts, an efficient content management and distribution system is crucial. This process includes content acquisition, ingestion, distribution, and archiving.

Many channels choose to outsource this process to external providers, ensuring that the content is delivered on time and in excellent quality. Alternatively, some channels use solutions that allow them to manage their own broadcasts.

Applications and equivalents that operate the channel themselves are cheaper but more vulnerable to errors and poor quality. Outsourcing is more expensive, but at best it provides higher quality and it’s more cost-effective.

Regulation

The FAST market still operates like the wild west, with far less regulation compared to traditional broadcasting. Currently, this allows channels to operate more cost-effectively and flexibly.

However, according to industry experts, this won’t last much longer. Regulations aimed at leveling the playing field are expected to be introduced in Europe soon. For consumers, this will have positive effects, ensuring for example that inappropriate ads won’t interrupt children’s programming. For channels, however, these changes will bring new operational requirements and challenges to navigate.

Success factors for FAST channels in Europe

To thrive in the European market, FAST service providers need to understand the landscape and find ways to stand out. At the same time, ensuring financial sustainability is crucial. Three key strategies for growing FAST channels in Europe were highlighted during panel discussions.

Localization is one of the most important factors for success. Especially when expanding internationally, it’s essential to conduct thorough research to grasp local languages and consumption habits. Localization isn’t limited to the content itself—it extends to subtitles, dubbing, and cultural preferences. For instance, Pluto TV offers local Finnish favorites like Suomen Huutokauppakeisari and Syke, which resonate well with the audience.

FAST channels rely heavily on advertising revenue, so maximizing ad visibility is critical.

Beyond traditional ads, sponsorships for specific channels or programs present a valuable opportunity. A show sponsored by a well-known brand can attract more attention. When sponsorship is paired with niche content, it can reach a dedicated, targeted audience that benefits all parties involved. The most successful FAST channels combine popular, marketable content with unique, engaging programming that fosters audience loyalty.

Technology also plays a pivotal role in driving ad revenue. Platforms equipped with smart algorithms can analyze user behavior and offer personalized content and targeted ads. This data-driven approach makes the service more attractive to advertisers. Not to forget other quality aspects of the stream!

Traditional media companies already hold strong positions in Europe, but for smaller players, this isn’t a David vs. Goliath scenario. Instead, it’s about fostering collaboration and partnerships across the production chain, from content creators to distributors. Strong cooperation ensures that FAST channels in Europe are well-managed, continuously improved, and better positioned for growth.

Pluto TV as a Pioneer in Finland

Since 2016, Media Tailor has managed the media logistics and playout for Nelonen Media’s linear TV channels and Ruutu VoD/SVoD channels. In the spring of 2023, Nelonen Media introduced Pluto TV, the largest FAST service provider on the market, to the Ruutu platform.

As a long-term partner, Media Tailor naturally played a role in the launch of this new service.

Media Tailor helped facilitate the introduction of this completely new streaming solution in Finland and developed the solution that enables seamless content delivery.

Although the service is brand new to Finland, Media Tailor’s platforms and processes scale efficiently to meet the demands of the new service. Thanks to Media Tailor’s digital platform, content delivery has been smooth and hassle-free.

Read more here. If you’re interested in our solutions for FAST, schedule a meeting, and we’ll tell you more!

Related posts

Blog

Blog AI Is Changing the Media Industry – Specialists Addressing Bias, Ethics, and Other Complexities and Advantages of AI

From increased creativity and saving society to bias and risks.…

Blog

Blog 5 Critical Factors for AI Success in the Media Industry

The success of AI is due to 5 different factors. The benefits of AI in the media and…

Blog

Blog Generative AI, Web3, And FAST – All You Need To Know About IBC2023 As A Broadcaster

The key themes of IBC2023 underscored many essential topics that…

News

News Media Tailor’s Digital Platform Enables Trendy FAST TV!

Media Tailor is transforming the way broadcasters, media houses, and other content providers can deliver trendy FAST TV…